It is very important to understand the concept of the AC formula because it helps a company determine the contribution margin of a product, which eventually helps in the break-even analysis. The break-even analysis can decide the number of units required to be produced by the company to be able to book a profit. Further, the application of AC in the production of additional units eventually adds to the company’s bottom line in terms of profit since the additional units would not cost the company an additional fixed cost. The actual amount of manufacturing overhead that the company incurred in that month was $109,000.

Why Use the Absorption Costing Method?

Companies must choose between absorption costing or variable costing in their accounting systems, and there are advantages and disadvantages to either choice. Absorption costing, or full absorption costing, captures all of the manufacturing or production costs, such as direct materials, direct labor, rent, and insurance. Absorbed cost, also known as absorption cost, is a managerial accounting method that includes both the variable and fixed overhead costs of producing a particular product. Knowing the full cost of producing each unit enables manufacturers to price their products. The main advantage of absorption costing is that it complies with generally accepted accounting principles (GAAP), which are required by the Internal Revenue Service (IRS).

Just-In-Time: History, Objective, Productions, and Purchasing

The salaries and benefits of supervisors and managers overseeing the production process are classified as fixed manufacturing overhead. This includes the cost of all materials that are directly used in the manufacturing process. These materials can be easily traced to a specific product, such as raw materials and components. The application of absorption costing extends across various sectors, each with its unique characteristics and cost structures. The method’s adaptability allows it to be tailored to the specific needs of different industries, from manufacturing to services and retail.

Financial vs Managerial Accounting Demystified

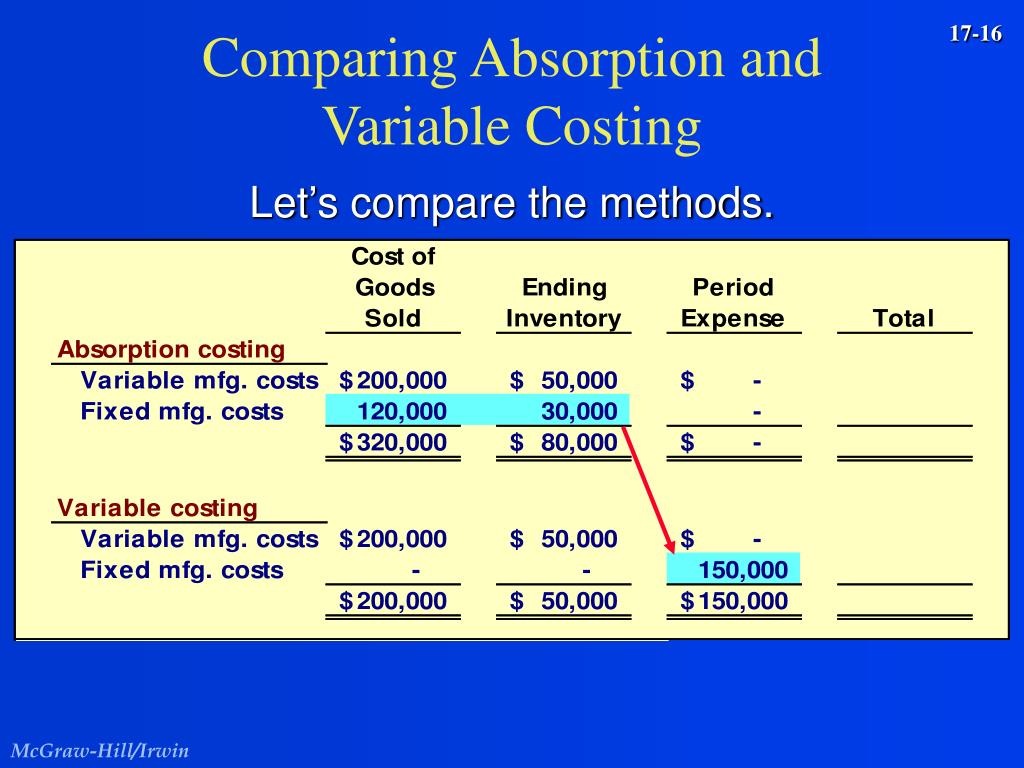

- Under absorption costing, companies treat all manufacturing costs, including both fixed and variable manufacturing costs, as product costs.

- Under generally accepted accounting principles (GAAP), U.S. companies may use absorption costing for external reporting, however variable costing is disallowed.

- The importance of absorption costing extends beyond mere compliance with accounting standards; it shapes how companies perceive their costs and profits.

- Absorbed overhead is manufacturing overhead that has been applied to products or other cost objects.

- Absorption costing is the accounting method that allocates manufacturing costs based on a predetermined rate that is called the absorption rate.

This can complicate operational decision-making, particularly in industries where cost control and pricing flexibility are crucial for competitiveness. Additionally, it is not helpful for analysis designed to improve operational and financial efficiency or for comparing product lines. Absorption costing is an easy and simple way of dealing with fixed overhead production costs. The absorption rate is usually calculating in of overhead cost per labor hour or machine hour. The products that consume the same labor/machine hour will have the same cost of overhead. The tax benefits of absorption costing can be particularly pronounced in periods of inventory accumulation.

Higgins Corporation budgets for a monthly manufacturing overhead cost of $100,000, which it plans to apply to its planned monthly production volume of 50,000 widgets at the rate of $2 per widget. The actual amount of manufacturing overhead that the company incurred in that month was $98,000. Additionally, best accounting software in 2021 can obscure the true variable cost of production, making it more challenging to conduct break-even analysis and perform cost-volume-profit (CVP) analysis. Managers seeking to make decisions based on the marginal cost of production may find the data less accessible, as fixed costs are distributed across units regardless of the actual production level.

Based on what happens to the product, it will be considered under the inventory calculation or considered under sales revenue and profit calculation. Absorption costing can cause a company’s profit level to appear better than it actually is during a given accounting period. This is because all fixed costs are not deducted from revenues unless all of the company’s manufactured products are sold.

Under absorption costing, the fixed manufacturing overhead costs are included in the cost of a product as an indirect cost. These costs are not directly traceable to a specific product but are incurred in the process of manufacturing the product. In addition to the fixed manufacturing overhead costs, absorption costing also includes the variable manufacturing costs in the cost of a product. These costs are directly traceable to a specific product and include direct materials, direct labor, and variable overhead. Absorption costing, also called full costing, is what you are used to under Generally Accepted Accounting Principles.

When we prepare the income statement, we will use the multi-step income statement format. The service sector presents a different set of challenges for absorption costing due to the intangible nature of its products. Unlike manufacturing, where physical goods are produced, service-based companies may not have traditional inventory.

This can lead to a situation where reported profits are higher in periods of increasing inventory levels, as some of the fixed costs are deferred to future periods. Conversely, in periods of decreasing inventory levels, profits may appear lower since more fixed costs are being expensed. Inventory valuation under absorption costing can therefore have significant implications for profit reporting and business performance analysis. In absorption costing, fixed costs such as rent, salaries, and utilities are allocated to products along with variable costs. This allocation is based on a predetermined rate, often driven by the normal capacity of production facilities or a specific activity base. For instance, if a factory is capable of producing 10,000 units in a month, and the fixed costs for that period are $50,000, then each unit would absorb $5 of fixed costs.

In this article, we’ll explore the fundamental concept of absorption costing for accounting in manufacturing. Absorption costing is viewed as the cornerstone of cost accounting in manufacturing businesses and plays a pivotal role in financial decision-making and performance evaluation. One of the main advantages of choosing to use absorption costing is that it is GAAP compliant and required for reporting to the Internal Revenue Service (IRS). As long as the company could correctly and accurately calculate the cost, there is a high chance that the company could make the correct pricing for its products. This article will discuss not only the definition of absorption costing, but we will also discuss the formula, calculation, example, advantages, and disadvantages. Expenses incurred to ensure the quality of the products being manufactured, such as inspections and testing, are included in the absorption cost.