This article explains the meaning, formula, and calculation of the PB ratio. To understand what is PB ratio in share market deeply, keep reading this detailed guide ahead. Since public companies are owned by shareholders, this is also known as the total shareholders’ equity. The book value includes all of the equipment and property owned by the company, as well as any cash holdings or inventory on hand.

How Can Companies Increase BVPS?

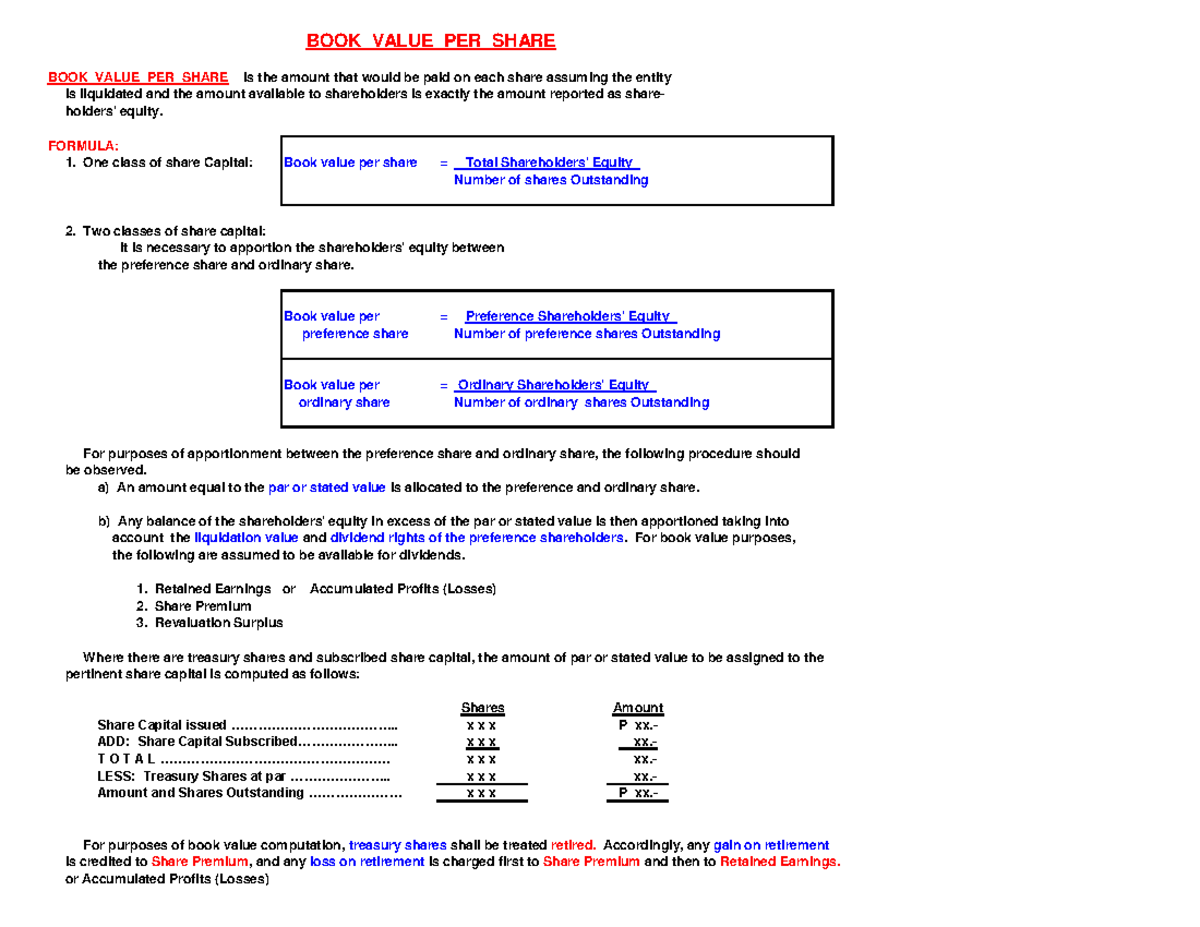

The book value per share is calculated using historical costs, but the market value per share is a forward-looking metric that takes into account a company’s earning power in the future. With increases in a company’s estimated profitability, expected growth, and safety of its business, the market value per share grows higher. Significant differences between the book value per share and the market value per share arise due to the how to design products with operations management in mind ways in which accounting principles classify certain transactions. To get BVPS, you divide the figure for total common shareholders’ equity by the total number of outstanding common shares. To obtain the figure for total common shareholders’ equity, take the figure for total shareholders’ equity and subtract any preferred stock value. If there is no preferred stock, then simply use the figure for total shareholder equity.

Why Is the Price-to-Book (P/B) Ratio Important?

Investors use BVPS to gauge whether a stock is trading below or above its intrinsic value.

Market Value Limitations

The term can be confusing, though, because it has one meaning when referring to an entire company and a slightly different meaning when referring to an asset. If a company has a book value per share that’s higher than its market value per share, it’s an undervalued stock. Undervalued stock that is trading well below its book value can be an attractive option for some investors. There are a number of other factors that you need to take into account when considering an investment. For example, the company’s financial statements, competitive landscape, and management team. You also need to make sure that you have a clear understanding of the risks involved with any potential investment.

She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business. There are other factors that you need to take into consideration before making an investment. However, book value per share can be a useful metric to keep in mind when you’re analyzing potential investments. On the other hand, if a company with outdated equipment has consistently put off repairs, those repairs will eat into profits at some future date. This tells you something about book value as well as the character of the company and its management.

Book Value Greater Than Market Value

It is quite common to see the book value and market value differ significantly. The difference is due to several factors, including the company’s operating model, its sector of the market, and the company’s specific attributes. The nature of a company’s assets and liabilities also factor into valuations. The increased importance of intangibles and difficulty assigning values for them raises questions about book value. As technology advances, factors like intellectual property play larger parts in determining profitability. Ultimately, accountants must come up with a way of consistently valuing intangibles to keep book value up to date.

But in the world of investing, being last in line can often be the best place to be, and the common shareholder’s lot can be the biggest piece of the profit pie. Taking this idea forward, investors will often look at a company’s book value per share or BVPS. Most often, the book value per share of a company will differ significantly from its current share price, with the latter usually more expensive. A market share price higher than the BVPS indicates that investors are bullish on the company. They’re willing to pay a premium above the current value of the per-share equity because they believe that equity will soon rise as the company grows.

This is how much every shareholder would receive after the company liquidates and pays its debts. Note that preferred shareholder equity isn’t included in this calculation because these shareholders receive priority claim in the event of liquidation. The book value of a company is based on the amount of money that shareholders would get if liabilities were paid off and assets were liquidated.

- It’s important to recognize that a higher market share price doesn’t necessarily mean the company is overvalued.

- The market value per share is a company’s current stock price, and it reflects a value that market participants are willing to pay for its common share.

- You can use the book value per share formula to help calculate the book value per share of the company.

- A business is usually seen as beneficial for investment if its P/B ratio is 1 or less.

- For asset-heavy industries, BVPS might provide a reasonable estimate of value.

For example, if a company faces protracted litigation that disrupts business operations, its share price might lag the book value per share. Now, let’s say that XYZ Company has total equity of $500,000 and 2,000,000 shares outstanding. In this case, each share of stock would be worth $0.50 if the company got liquidated. To calculate book value per share, simply divide a company’s total common equity by the number of shares outstanding. For example, if a company has total common equity of $1,000,000 and 1,000,000 shares outstanding, then its book value per share would be $1. You need to know how aggressively a company has been depreciating its assets.